Enhanced Auto Hedging Process

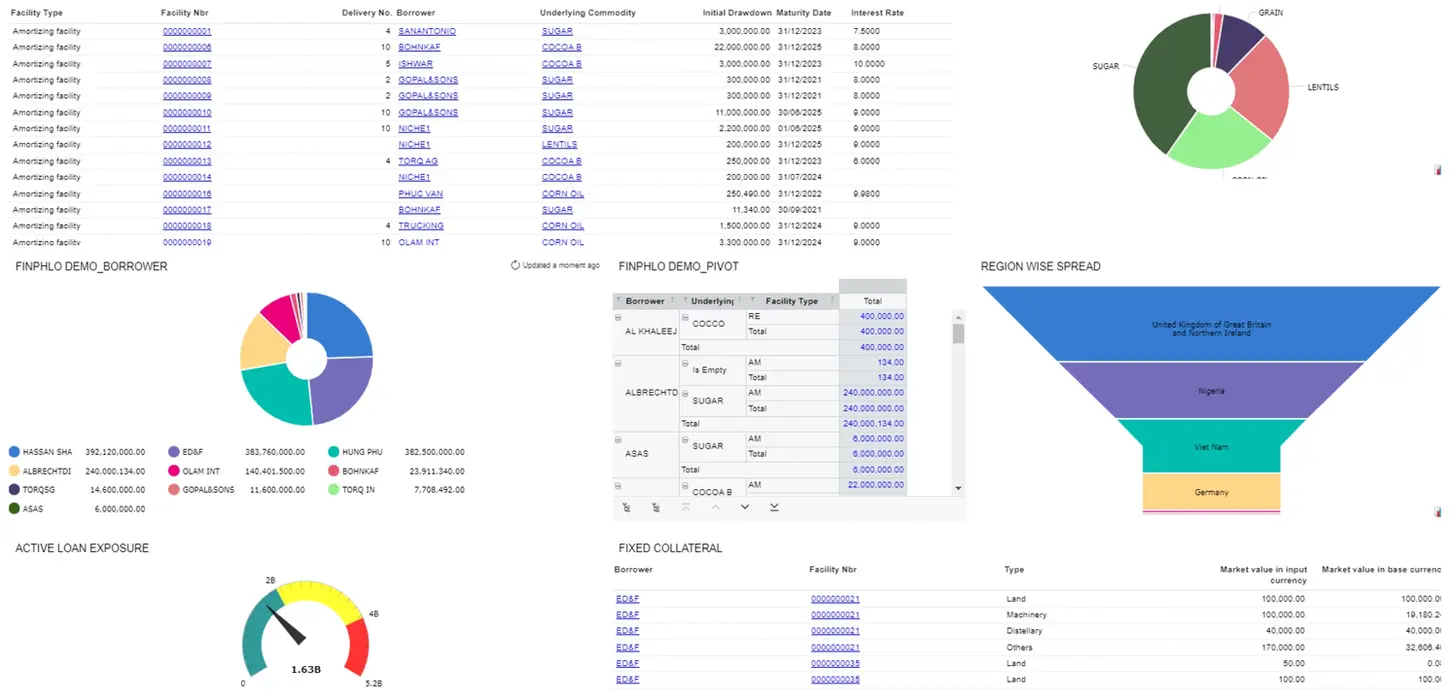

Our Trade Finance Management solution simplifies day-to-day operations by centralizing all aspects of trade finance, from KYC to loan servicing, collateral management, and more. Integrated with accounting systems, our platform enables real-time PnL and balance sheet generation, providing full visibility into financial performance. Features such as robust collateral management, accurate repayment tracking, and streamlined facility creation ensure efficient management of complex financial transactions, while advanced deal sourcing and KYC capabilities offer insights into potential deals and partners.

Centralized Operations

Manage all trade finance operations from KYC to loan servicing in one platform.

Real-Time Financial Insights

Generate PnL and balance sheets in real-time for enhanced financial visibility.

Efficient Process Automation

Streamline facility creation, legal documentation, and loan covenant management.

Increased Visibility

Gain insights into portfolio performance and financial health.

Improved Efficiency

Streamline trade finance operations and save time with automated processes.

Cost Reduction

Reduce operational costs and increase productivity.

Enhanced Risk Management

Minimize risk exposure with accurate tracking and reporting.

Advanced Trade Finance ERP for non-bank structured trade financers

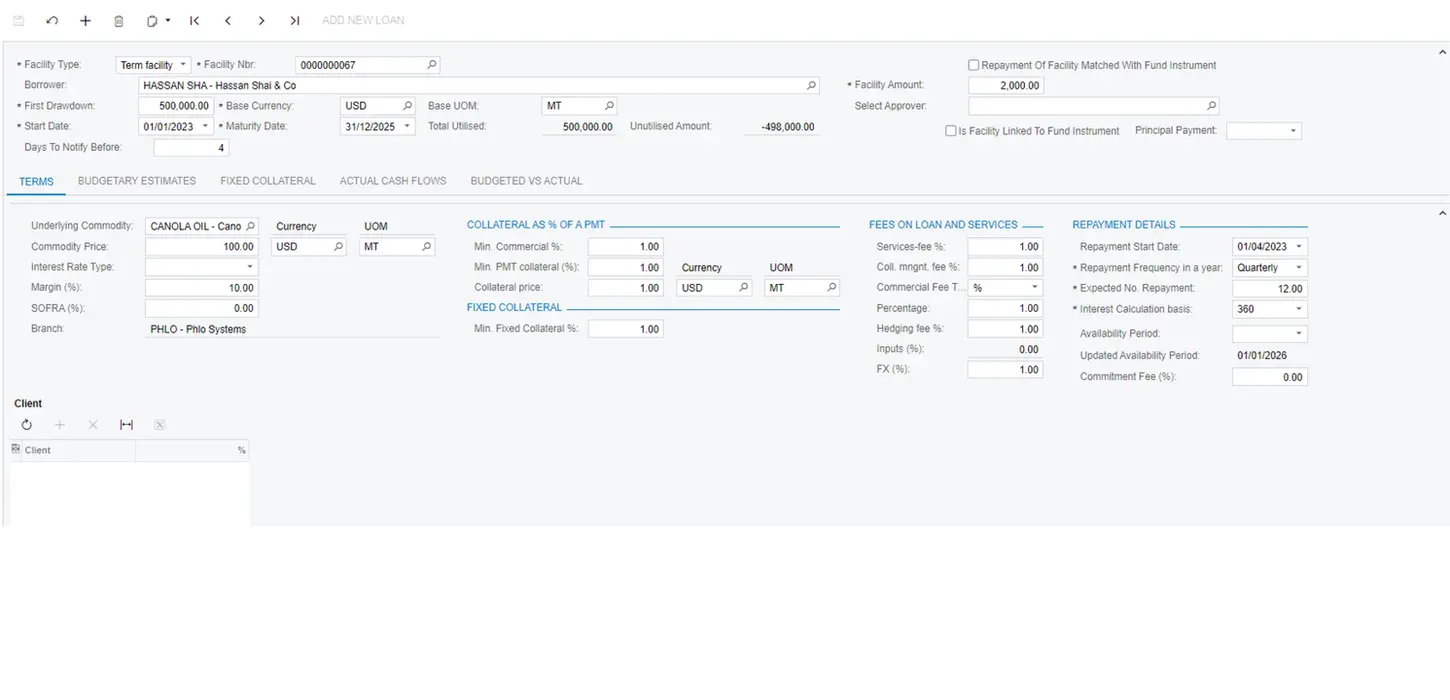

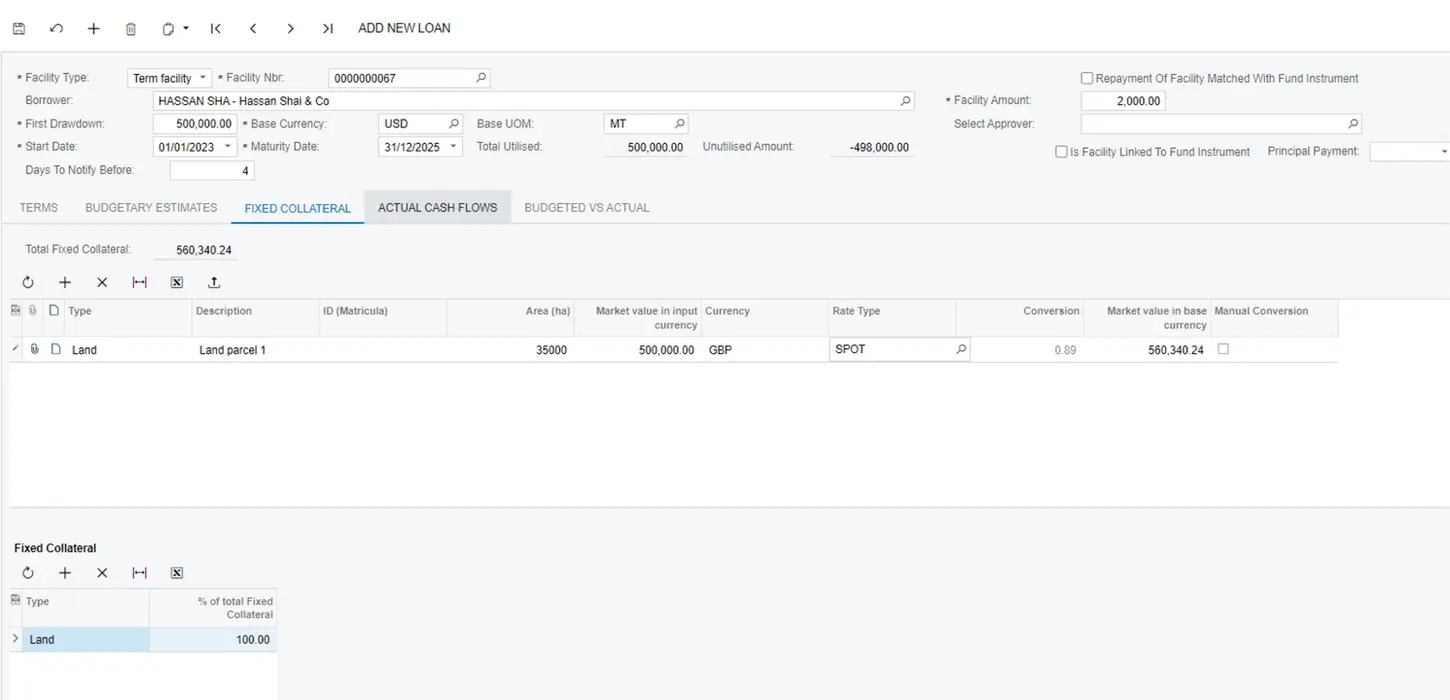

Robust Collateral Management

Ensure accuracy and reduce risk in collateral management.

Comprehensive Loan Guarantees

Provide additional security and protection for lenders.

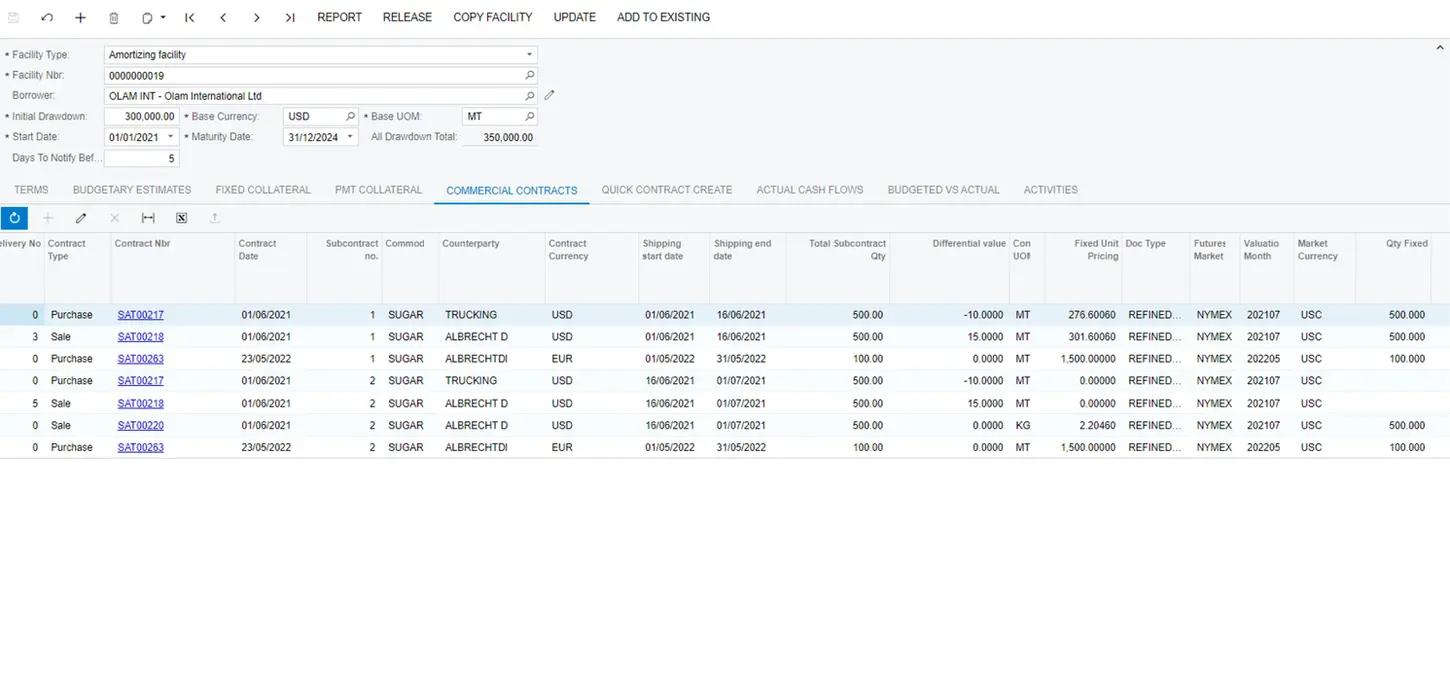

Invoice and Contract Visibility

View assets and liabilities comprehensively for informed decision-making.

Accurate Repayment Tracking

Stay updated on portfolio performance with real-time repayment tracking.

Advanced KYC Capabilities

Gain insights into potential deals and partners with advanced deal sourcing and KYC.

Streamlined Facility Creation

Save time and effort with efficient facility creation and legal documentation processes.

Frequently Asked Questions

A

Yes, our platform allows for real-time PnL and balance sheet generation, providing instant insights into financial performance.

Q

Can I generate financial reports in real-time?

A

Our platform offers robust risk management features, including accurate tracking of loan covenants and comprehensive collateral management, to minimize risk exposure.

Q

How does the solution help in risk management?

A

Yes, our cloud-based infrastructure ensures scalable and high-performance access from any device, anywhere in the world.

Q

Is the platform accessible from anywhere?

A

Yes, our platform includes an external user portal for borrowers, lenders, and supply chain partners to streamline communication and collaboration.

Q

Can I collaborate with external stakeholders?

A

We employ advanced security features like encryption and multi-factor authentication to ensure the safety and privacy of user data.

Q

How does the platform ensure data security?

Interested in working with us?

Social Media

Phlo Systems, 3rd Floor, The News Building, 3 London Bridge St, London SE1 9SG

© 2025 by Phlo Systems

Interested in working with us?

Social Media

Phlo Systems, 3rd Floor, The News Building, 3 London Bridge St, London SE1 9SG

© 2025 by Phlo Systems