Eurozone Cuts Interest Rates Amid Global Economic Shifts: Implications and Insights

- Swasti Sharma

- Jun 7, 2024

- 4 min read

Updated: Oct 2, 2024

The European Central Bank (ECB) has taken a significant step by cutting its main interest rate from an all-time high of 4% to 3.75%. This marks the first rate cut in five years and aligns with similar moves by other global economies, including Canada. As voters prepare for EU-wide elections, the rate cut reflects the ECB's strategy to tackle inflation and stimulate economic growth.

Introduction

ECB's Decision to Eurozone Cut Interest Rates

The ECB made the strategic decision to lower interest rates in order to address the economic difficulties facing the Eurozone. This move fits within a larger pattern of global economic readjustment, as central banks in Canada, Sweden, and Switzerland have also lowered their interest rates. Although there are indications that inflation will continue to exceed the European Central Bank's 2% objective far into next year, Christine Lagarde, President of the ECB, emphasized the better inflation forecast as a major determinant in the decision.

The Context of the Rate Cut

worldwide economic conditions

For the past two years, high interest rates have characterized the global economic environment in an effort to contain inflation. But the growth of the economy has also been slowed by these high rates. It is anticipated that the ECB's rate reduction will boost economic activity by lowering the cost of borrowing for both consumers and companies.

Canada's Latest Rate Reduction

Earlier this week, Canada decided to lower its official lending rate from 5% to 4.75%, setting a precedent. The decrease in inflation to 2.7%【source】 was the impetus for this action. Similar in strategy, the ECB's decision suggests that big economies work together to reinvigorate growth and control inflation.

The Eurozone's Inflation and Economic Growth

In May, inflation increased slightly from 2.4% in April to 2.6%, but the European Central Bank nonetheless chose to lower interest rates. The central bank's forward-thinking stance and confidence in the overall economic outlook are demonstrated by this decision. Even while the ECB is aware of potential obstacles in the near future, its main objective is still to lower inflation to its target of 2%.

Impact on Consumers and Businesses

Effects of the Rate Cut Right Away

It is anticipated that the rate reduction will bring much-needed relief to businesses and consumers. Reduced borrowing rates have the potential to increase investment and spending, which will increase economic activity. While many people across the continent will still be relieved by the rate decrease, Lindsay James, an investment strategist at Quilter Investors, pointed out that it was expected.

Extended Economic Prognosis

The long-term economic picture is still reasonably favorable. Chief European economist Katherine Neiss of PGIM expressed confidence that the ECB would keep lowering rates during the summer or fall, possibly pushing them down to 3.5% or less by year's end. It is believed that this continuous adjustment is necessary to aid in the recent recession's recovery.

Political and Geopolitical Considerations

Elections Across the EU and Public Attitude

The rate cut's timing—which aligns with elections across the EU—is noteworthy. The results of these elections should demonstrate the public's discontent with the strains imposed by rising costs of living. Voter mood may be impacted by the ECB's decision, underscoring the relationship between political dynamics and economic policy.

Dangers in Geopolitics

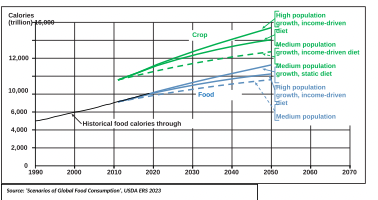

Citing geopolitical tensions in the Middle East and Ukraine, Christine Lagarde underlined the possible "bumps in the road" for the Eurozone. In addition to the threats to economic development and stability posed by these conflicts, the inflation forecast may be further complicated by the possibility of rising food costs due to climate change and harsh weather.

Comparisons with Other Major Economies

Rate Strategy of the United Kingdom

Although there has been no rate reduction in the UK, there is talk that the Bank of England may do so as soon as this month. There is pressure on the Bank to act accordingly, since inflation has dropped from its peak of nearly 11% in late 2022 to 2.3% currently. Complexity is increased by the impending UK election, as political factors may have an impact on the Bank's choices.

The US Federal Reserve's Strategy

In the upcoming months, rate cuts by the US Federal Reserve are also anticipated. The US is currently experiencing higher inflation than both Europe and Canada, at 3.4%. The timing of the Fed is crucial, particularly in light of the elections in November. Analysts believe that in order to stay out of politics, the Fed will take action before to the elections.

Future Economic Policies and Predictions

Possibility of Additional Rate Reductions

Experts in economics expect that the ECB will probably keep lowering interest rates. The goal of this plan is to maintain the Eurozone's economic recovery from the recession that it endured at the end of the previous year. The ECB intends to strike a balance between reining in inflation and promoting economic growth by progressively lowering rates.

Managing Growth and Inflation

As it lowers rates to promote growth, the ECB's present position is to maintain interest rates "sufficiently restrictive" to control inflation. It will be necessary to closely monitor economic data and make timely policy adjustments in order to maintain this fragile equilibrium.

Broader Economic Implications

The broader economic implications of the ECB's rate cut are significant. By lowering borrowing costs, the ECB aims to inject vitality into the Eurozone economy. This move is part of a larger global trend where central banks are recalibrating their policies to foster sustainable growth amidst lingering inflationary pressures.

Conclusion

The ECB's move to lower interest rates is a significant turning point for the Eurozone economy. This action represents a calculated attempt to control inflation and promote growth in the face of changing global economic conditions and impending EU elections. The rate decrease provides a way forward for economic recovery, even though there are still obstacles to overcome, such as geopolitical threats and the ongoing climate problem. The global economic scene is about to undergo big changes in the upcoming months as other major economies, such as Canada and even the US and UK, adopt comparable tactics.

Comments